WE MAKE SAVING EASY

Savings App Concept

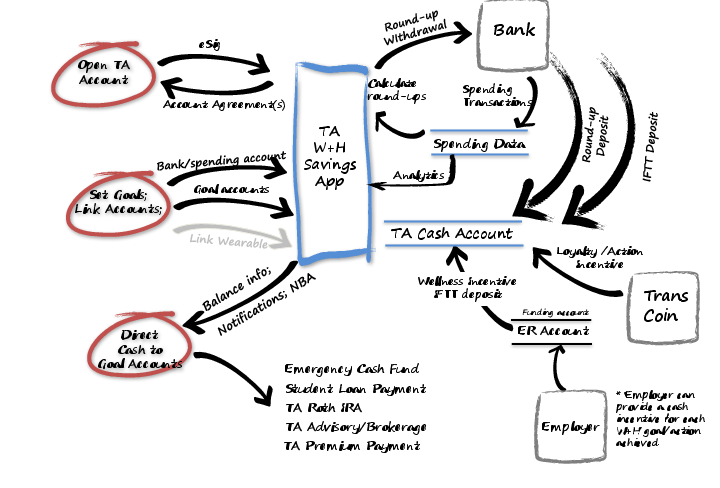

Context Diagram

Initial flow sketches and ideas.

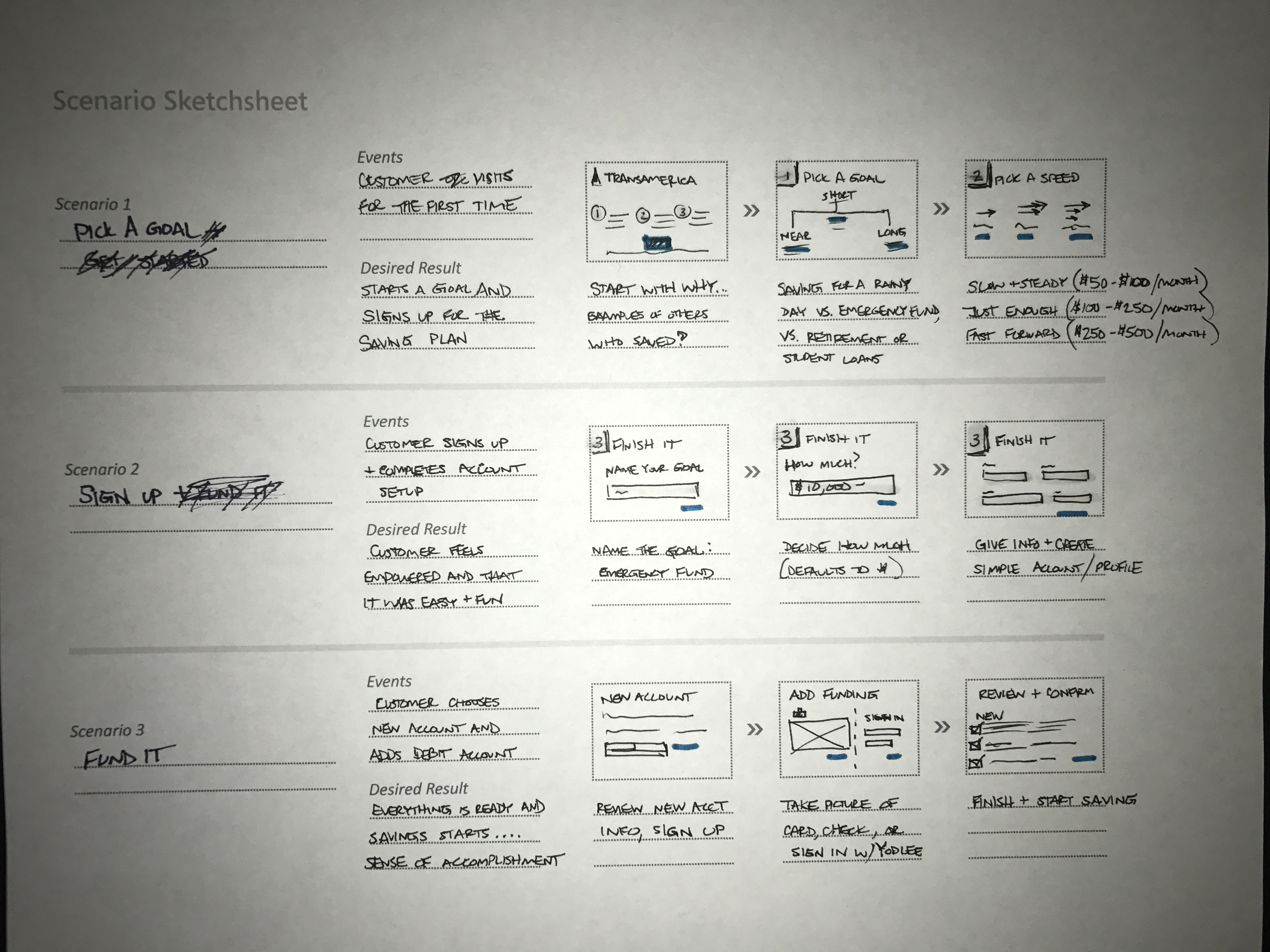

1) PICK A GOAL

What if we based it on timeframe? Most goals in similar experiences are set based on a specific item our outcome (student debt, save for a gift, etc.). What if we made it more time-based so people can relate to something short-term and easier vs. long-term and harder to imagine? It makes it less restrictive and helps people shift their thinking further into the future (framing for retirement, etc.).

- Near term (saving for rainy day fund)

- Short term (saving for an emergency fund)

- Long term (saving for retirement)

2) PICK A SPEED

Speed might not be the right framing, but what if there was an easier way to determine how much you wanted to save in a time period? The tough thing with Qapital is that you sometimes can't gauge with the rules how much it might pull in a given month from your account. It feels a little less controllable or predictable, which could erode trust in the rules or the whole experience. Give people an easy framing with ballpark amounts that rules might save in a month. If someone picks "Slow and Steady", it might enable one rule to start and save less than if someone pics "Fast Forward" which might activate several concurrent rules and save more in a month.

- Slow and Steady ($50 - $100 a month)

- Just Enough ($100 - $250 a month)

- Fast Forward ($250 - $500 a month)

3) FINISH AND SIGN UP

Other stuff that needs to be captured. Usually this is the boring and frustrating part, but maybe we can make it simpler and faster? Also in most apps this comes first and gets in the way of exploring the value proposition. Save it for last once someone gets far enough along to help them more easily accept that last step to completing setup.

- Quick Personal Info/login (name, email, create password, give phone, get text confirmation, confirm, create passcode)

- Start a new TA account (quick disclaimer, approve)

- Pick a debit account (scan card or sign in with Yodlee)

- Review info/confirm

- E-sign to get started

- Welcome/Go

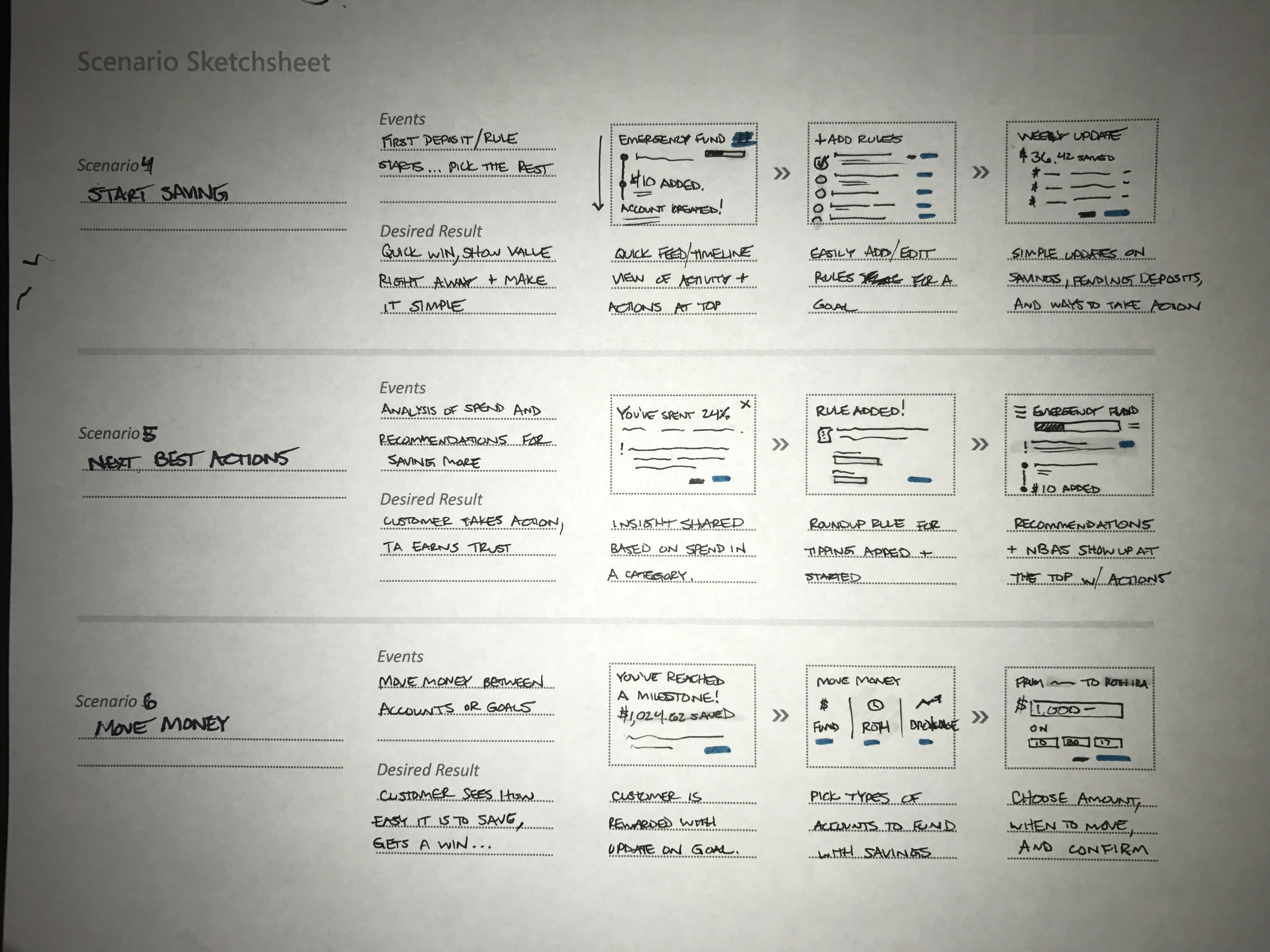

4) START SAVING

Fund it first (first deposit added right away?) (incentive added by us?) Rules start tracking and saving (default to a rule so it's less mental effort?) Updates/notifications on rules/activity (make them fun, engaging, non-app based) Suggestions on next steps (NBAs, insights from spending, etc.) Weekly update before depositing/pulling money? (be transparent) Monthly goal progress ...

5) TRACKING & ACTIONS

View Profile (my accounts, my goals, my rules, support, invite people, cancel, etc.) Upcoming deposits & transfers (review, cancel, change date?) Rules (add new, pause current, change current, move to another goal, change funding option, cancel current) Goals (add new, edit info, change funding, remove) Invite (tell someone and get $10) Move Money (between goals, between accounts, pay bills, manual deposits, mail a check, set up direct deposit)

6) EXAMPLE RULES

Restaurant Roundup (add 5% of the tab to the account as a penalty for eating out) Budget Beater (set a limit for a budget category, come in under, save the difference) Tough Love (put a little in savings whenever you buy the stuff you’re trying to resist) Fitness Goal (link your Fitbit or Apple Health and reward yourself for hitting fitness goals) Countdown Rule (save increasing amounts weekly until you hit a targeted date) Meet your Match (meet an employer’s challenge amount and earn multipliers on your savings) Stress Less (we’ll ask you daily how you’re feeling … the better you feel, the more you save)

Conversations

What personality should it have? What should it say to be a trusted partner?

You spend 24% more on dining out than people like you. I challenge you to eat out one less night per week for the next month. If you do, [your employer] will deposit $25 to your [goal name]. ACTION: "Challenge Accepted" OR "Maybe Next Time"

You just saved toward your first goal! $4.53 is going into your [name] goal.

You’ve saved $320.61 in total and reached a milestone (10% of your goal)!

You rounded up $7.78 at Ink Coffee and saved $.22 toward [goal name].

You completed week 24 of 52 and saved $24.00 for your [goal name].

It looks like you’re paying 28% of your income on student loan debt. Debt consolidation might save you on your monthly payment. Want to explore options? [LINK]